Within the age of digital transactions and contactless funds, many have declared the common-or-garden paper examine as an out of date relic of the previous. Nonetheless, this declare is much from correct. Regardless of the rise of digital fee strategies, checks proceed to play an important position in varied monetary transactions, and their demise has been vastly exaggerated.

The enduring significance of checks

Whereas it’s true that the usage of checks has declined over time, they continue to be a vital fee technique for a lot of people and companies. Checks provide a number of benefits that make them indispensable in sure conditions:

- Accessibility: Not everybody has entry to digital fee strategies or feels comfy utilizing them. Checks present a well-recognized and easy manner for people of all ages and backgrounds to conduct monetary transactions.

- Recordkeeping: Checks provide a tangible paper path, making them priceless for record-keeping functions. This characteristic is especially vital for companies that want to keep up detailed monetary information for accounting and tax functions.

- Safety: Opposite to in style perception, checks generally is a safe fee technique when used accurately. They require bodily signatures and could be traced again to the issuer, offering a further layer of safety in comparison with some digital fee strategies.

- Flexibility: Checks can be utilized for varied transactions, from paying payments and hire to creating massive purchases or settling authorized obligations. Their versatility makes them a priceless software in numerous monetary situations.

Addressing widespread myths

Regardless of their continued relevance, a number of myths persist concerning the usage of checks. Let’s deal with a few of the most typical misconceptions:

- Checks are out of date: As mentioned earlier, checks stay a vital fee technique for a lot of people and companies. Whereas their utilization could have declined, they’re removed from out of date and proceed to serve vital features.

- Checks are inconvenient: Whereas checks could require extra effort than some digital fee strategies, they don’t seem to be essentially inconvenient. For individuals who are acquainted with the method, writing and depositing checks could be simple and environment friendly. Moreover, with the arrival of cell banking apps, depositing checks has develop into extra handy than ever.

- Checks are unsafe: When dealt with correctly, checks generally is a safe fee technique. They require bodily signatures and could be traced again to the issuer, making them much less vulnerable to sure kinds of fraud in comparison with digital funds. Nonetheless, it’s vital to comply with finest practices, equivalent to safeguarding checks and promptly reporting any misplaced or stolen checkbooks.

- Checks are costly: Whereas checks could contain some processing charges, the prices related to their use are sometimes minimal, particularly for people and small companies. Many monetary establishments provide free or low-cost check-writing providers, making checks an reasonably priced fee choice.

In sure conditions, people could must money a examine however lack correct identification, and one widespread subject that arises is how to cash a check without ID. This generally is a problem, as most monetary establishments require a sound ID to money checks as a safety measure. Nonetheless, there are different strategies that may be explored, equivalent to having the examine endorsed by the issuer or offering different types of identification like a utility invoice or bank card assertion.

The way forward for checks

Whereas digital fee strategies proceed to realize reputation, it’s unlikely that checks will disappear fully anytime quickly. They serve particular functions and cater to varied demographics and industries that also depend on paper-based transactions.

Nonetheless, monetary establishments and fee processing firms nonetheless must adapt and provide revolutionary options that bridge the hole between conventional and fashionable fee strategies. This might embrace enhancing cell examine deposit capabilities, streamlining examine processing, and bettering safety measures to additional bolster the reliability and comfort of check-based transactions.

Finally, the choice to make use of checks or digital fee strategies will depend upon particular person preferences, circumstances, and the particular necessities of every transaction. By understanding the myths and realities surrounding checks, customers and companies could make knowledgeable decisions and leverage the fee strategies that finest go well with their wants.

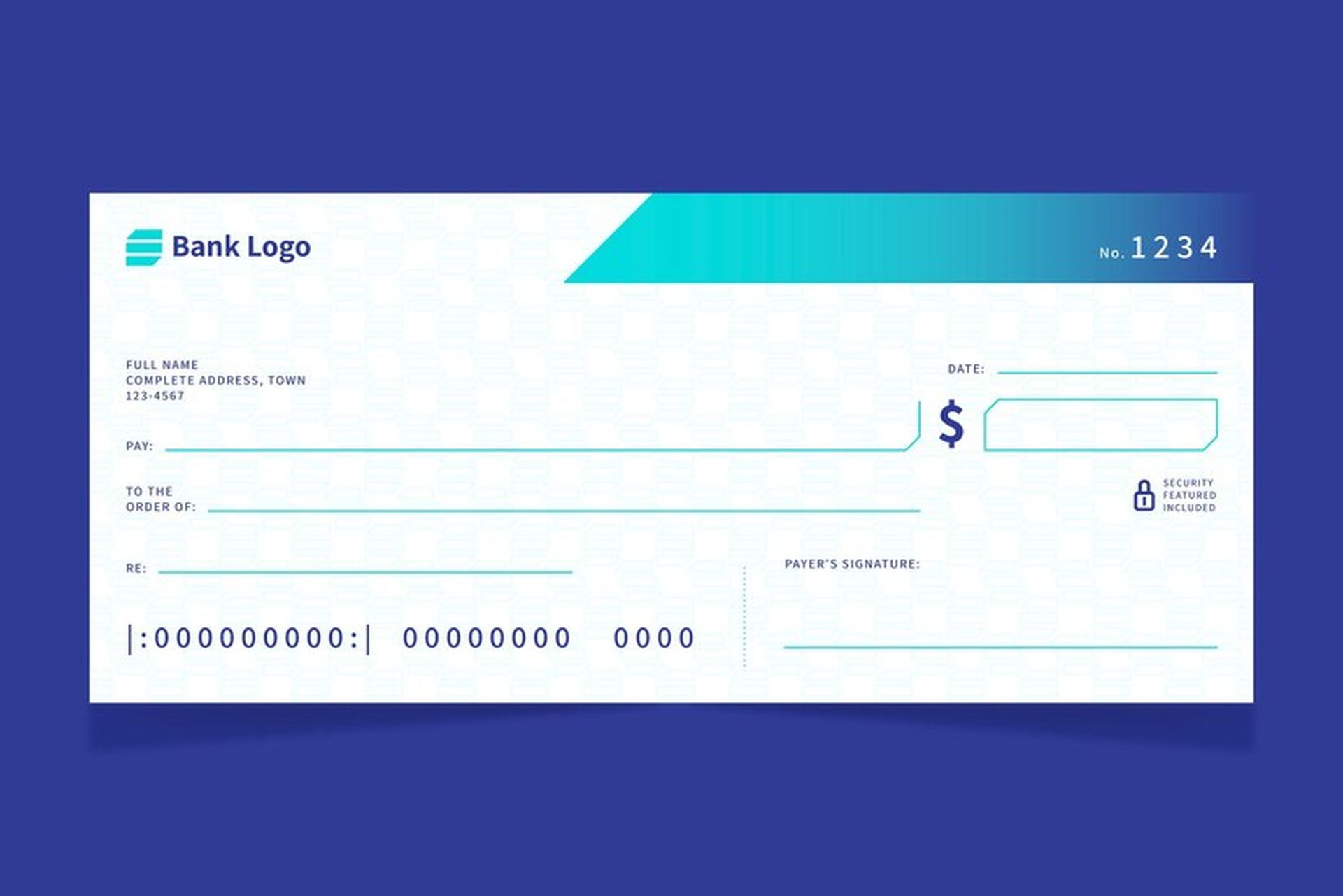

Featured picture credit score: Freepik